In brief

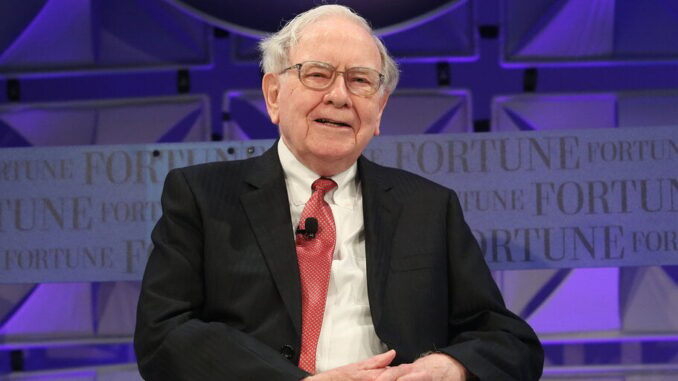

Warren Buffett will step down from his role as Berkshire Hathaway CEO at the end of the year.

Buffett is an immensely successful investor, but has harshly criticized Bitcoin on multiple occasions.

Berkshire Hathaway CEO Warren Buffet announced plans over the weekend to step down at the end of the year, after turning his company into one of the world’s most profitable firms—with a 5,500,000% return on investment since he took the helm.

But he never cottoned to Bitcoin, although his stance about the technology behind digital assets softened over time.

The 94-year-old Buffett, who made his surprise announcement at Berkshire Hathaway’s annual shareholder meeting, maintained that Bitcoin would never endure as a unit of value, and once famously called Bitcoin “rat poison squared” in a May 2018 interview with CNBC’s “Squawk Box.” He remained skeptical of its usefulness, even after meeting with some of the industry’s most powerful advocates.

In a 2018 interview with CNBC earlier in the year, Buffett had said that “cryptocurrencies, generally… with almost certainty… will come to a bad ending.”

“When it happens or how or anything else, I don’t know,” he added in an interview from Omaha, Nebraska. “If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it, but I would never short a dime’s worth.”

“We don’t own any, we’re not short on any, we’ll never have a position in them,” he added. “I get into enough trouble with things I think I know something about,” he added. “Why in the world should I take a long or short position in something I don’t know anything about?”

As recently as 2023, even as the price of the asset had surged to new highs in the years prior, Buffett called Bitcoin a “gambling token.” He said that people investing in it were chasing easy money, and that investors wanted to “play the roulette wheel” by putting funds into it.

To be sure, Buffett was a reluctant tech investor, whose portfolio weighted more to companies in manufacturing and other traditional industries. He began buying shares in Apple only in 2016, although the personal device manufacturer later became the largest part of his holdings.

Buffett’s rhetoric about the technology behind Bitcoin changed over the years, too.

In a 2019 CNBC interview he said “blockchain was important,” although he called Bitcoin “a delusion” in the same discussion.

His remarks echoed the opinions of financial services titans, including JP Morgan CEO Jamie Dimon and BlackRock CEO Larry Fink, who praised blockchain technology but slammed Bitcoin. Those firms have subsequently debuted multiple crypto-focused initiatives over the years and shown an increasing willingness to embrace digital assets as a long-term fixture. (Fink is now a fan of Bitcoin; Dimon not so much.)

Buffett reiterated his own more nuanced Bitcoin-Blockchain stance during a fancy dinner with Tron founder and crypto mogul Justin Sun, saying that while Bitcoin was just value changing hands and “no different from a seashell,” crypto companies were here to stay.

“Bitcoin cannot capture the value of blockchain,” he said at the much-publicized 2020 dinner date. “Just because something has value doesn’t make it a good investment,” Buffett added.

Buffett made a living off seeing a company’s value before everyone else, buying up its shares and being patient. But his distaste for the so-called digital gold was perhaps understandable: Buffett also famously avoided commodities like gold and oil.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Be the first to comment